Strategic Transaction Significantly Expands Vertiv’s Offering; Vertiv Also Updates Business Conditions

- Meaningfully completes Vertiv’s data center offering by adding a leading independent

provider of switchgear, busway and modular power solutions; - Expands Vertiv’s addressable market by $7 billion, entering an attractive global market

growing at mid-single digits; - Expected to be accretive to Vertiv’s organic growth, adjusted operating margins, cash flow

and adjusted EPS; and - Core Vertiv business continues to see robust order and backlog growth but supply chain

disruptions have accelerated; updating guidance to reflect latest market conditions.

COLUMBUS, Ohio [Sept. 8, 2021] -- Vertiv Holdings Co (“Vertiv”) (NYSE: VRT), a global provider of critical digital infrastructure and continuity solutions, today announced that through its subsidiaries, it has entered into a definitive agreement to acquire E&I Engineering Ireland Limited and its affiliate, Powerbar Gulf LLC (“E&I”) for approximately $1.8 billion in upfront consideration plus the potential for up to $200 million in cash, based on achieving certain 2022 profit milestones. The upfront consideration consists of $1,170 million in cash and approximately $630 million of Vertiv common stock. The transaction has been unanimously approved by Vertiv’s Board of Directors and is expected to close in the fourth quarter of 2021, subject to customary closing conditions.

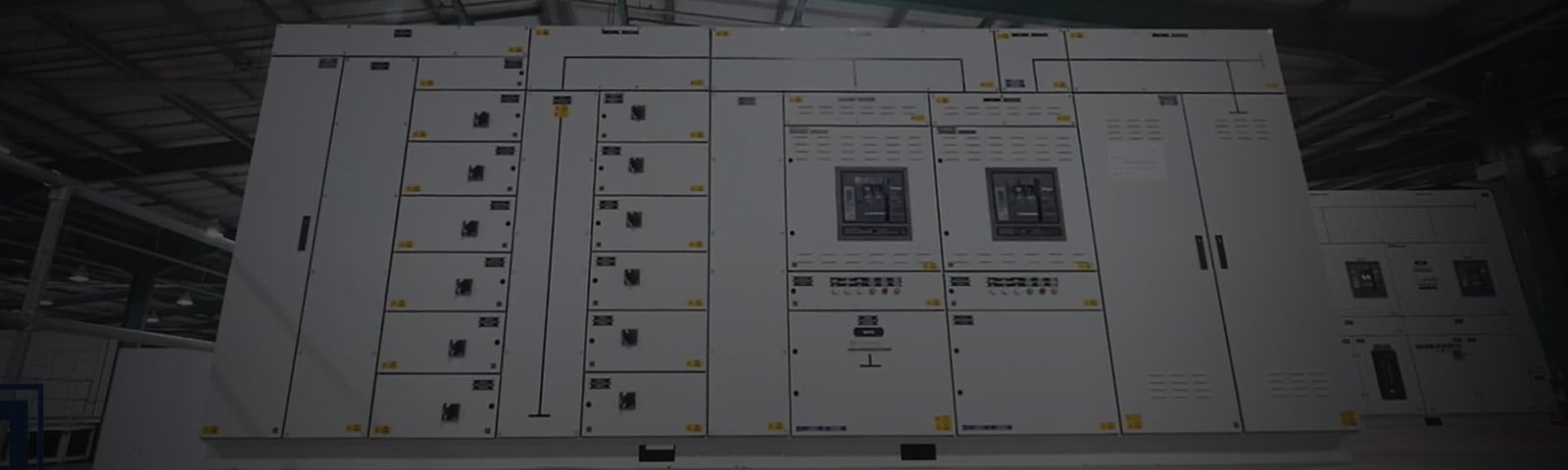

Founded in 1986 by Philip O’Doherty, E&I is a leading independent provider of electrical switchgear and power distribution systems, pioneering unique in-house integrated power solution designs and technology tailored to individual client project needs. With annual sales of approximately $460 million (2021E) and 2,100 employees, E&I has a long heritage in the power distribution market and deep relationships with a blue-chip customer base in more than 30 countries. E&I’s products represent a critical system of the data center power infrastructure and compete in an addressable market of about $7 billion, which is expected to grow 5% annually through 2025.

“The acquisition of E&I represents a key milestone in Vertiv’s strategy, completing our portfolio of in-building power train offerings for data centers and vital commercial and industrial markets,” said Rob Johnson, Vertiv’s Chief Executive Officer. “The combination will amplify Vertiv’s growth opportunities and profitability, while enabling Vertiv to deliver differentiated solutions that manage a customer’s entire power infrastructure as an integrated system. We look forward to adding E&I’s highly skilled team members to the Vertiv family. Our companies share a strong culture of engineering excellence and innovation and a passion for serving our customers with differentiated products and service.”

“While this deal marks the first acquisition by Vertiv since becoming a public company, our team has thoughtfully followed acquisition best practices during the process of identification, valuation, due diligence and integration planning. E&I represents a unique opportunity for Vertiv and it fits well in the Vertiv portfolio. I am excited about the potential of these two great businesses coming together as one,” said Dave Cote, Vertiv’s Executive Chairman.

“This transaction brings together two highly complementary businesses and represents a great outcome for E&I’s employees and customers,” said Philip O’Doherty, founder and Chief Executive Officer of E&I. “We are excited to join the Vertiv team and to continue to grow our business through Vertiv’s global reach, strong channel presence and great customer positioning in critical digital infrastructures.”

Compelling Strategic and Financial Benefits

- Highly Complementary Product Portfolio with Differentiated Technology. E&I’s products in critical power switchgear, UPS input and output switch gear and busway fill the remaining gaps in the Vertiv critical power infrastructure offering.

- Broad Global Customer Base. Together, Vertiv and E&I will serve some of the world’s leading hyperscale cloud and colocation companies that are increasingly looking to suppliers to have a full “powertrain” capability and flexible power deployment options to support increasingly demanding power requirements.

- Significant Geographic Expansion Potential. E&I today competes in North America, Europe and the Middle East. This transaction provides the opportunity to leverage Vertiv’s footprint outside of the United States, particularly in Europe and Asia to rapidly expand penetration with new customers.

- Attractive Cost and Revenue Synergies. The combination is expected to yield excellent sales synergies; however no sales synergies are contemplated in the base financial model so they represent incremental upside. Vertiv expects to realize approximately $18 million in pre-tax run rate cost synergies within three years of close. Cost synergies will come from a combination of procurement, general, administrative and product costs. Revenue synergy opportunities are driven by highly complementary customers and products to support cross-selling and integrated solutions for each company’s customers.

- Accretive to Vertiv’s Financial Profile. The transaction is expected to be accretive to Vertiv’s organic growth, adjusted operating margins, cash flow and EPS in 2022.

Transaction Details

Under terms of the agreement, E&I will receive upfront consideration of approximately $1.8 billion, consisting of $1,170 million in cash and approximately $630 million of Vertiv common stock, issued at the volume-weighted average closing price per share over the 60-day trading period ended Sept. 7, 2021, and equating to 23.1 million shares. Up to $200 million of additional cash consideration would be payable based upon the achievement of certain 2022 EBITDA targets, with $100 million paid if E&I achieves 2022 EBITDA of $146 million and an incremental $100 million if E&I achieves 2022 EBITDA of $156 million or higher. Assuming expected 2022 EBITDA of $150 million, the resulting $1.9 billion purchase price – including $100 million of additional consideration based upon the above thresholds – represents a multiple of about 11x 2022 EBITDA including expected run rate year-three cost synergies of $18 million.

Vertiv plans to finance the transaction with cash on hand and new debt financing, supported by committed financing. At the close of the transaction, Vertiv expects an adjusted net leverage ratio of about 3.4x net debt to adjusted EBITDA, which is expected to de-lever to approximately 2.3x by year end 2022. The company expects the transaction to close in the fourth quarter of 2021 subject to receipt of regulatory approvals and satisfaction of customary closing conditions.

Centerview Partners LLC is acting as lead financial advisor to Vertiv, and Baker McKenzie and Latham & Watkins provided legal counsel. Rothschild & Co is acting as sole financial advisor to E&I and Clifford Chance provided legal counsel. Committed financing to support the transaction is being provided by Citi, that also acted as a financial advisor to Vertiv.

Updated Business Conditions

Vertiv today also provided an update on current business conditions. Overall market demand remains robust and consistent with expectations. Orders in July and August were up approximately 12% compared to the same period last year, driven by continued strength in cloud and colocation markets. Order growth drives a record backlog of about $2.4 billion at the end of August, a 30% increase from year-end 2020.

Despite continued strong market demand, supply chain challenges described in our prior communications are trending worse than expected, with critical part shortages driving the need for additional spot buys. In some cases, the company cannot procure critical parts at any price, creating production and delivery challenges pressuring the top-line. Vertiv is taking actions to address these challenges, which are expected to continue through the first half of 2022.

Given these pressures, Vertiv is revising its guidance for the third quarter and full year 2021. The revised guidance reflects current market conditions and anticipates no improvements until next year, which Vertiv considers prudent but could prove conservative. A summary of the revised guidance compared with prior guidance is provided below:

| Prior Q3 2021 Guidance | Revised Q3 2021 Guidance | |

|---|---|---|

| Net sales | $1,260M - $1,300M | $1,210M - $1,250M |

| Organic net sales growth1 | 6.5% - 9.5% | 2.5% - 5.5% |

| Adjusted operating profit2 | $155M - $165M | $125M - $135M |

| Adjusted operating margin | 12.3% - 12.8% | 10.3% - 10.8% |

| Adjusted EPS | $0.26 - $0.30 | $0.17 - $0.20 |

| Prior FY 2021 Guidance | Revised FY 2021 Guidance | |

| Net sales | $4,970M - $5,030M | $4,880M - $4,940M |

| Organic net sales growth1 | 11.5% - 12.5% | 9.5% - 10.5% |

| Adjusted operating profit | $590M - $610M | $530M - $550M |

| Adjusted operating margin |

11.8% - 12.2% | 10.9% - 11.1% |

| Adjusted EPS |

$1.12 - $1.18 | $0.96 - $1.01 |

| Free Cash Flow |

$290M - $310M | $190M - $220M |

1 This is a non-GAAP financial measure that cannot be reconciled for those reasons set forth under “Non-GAAP Financial Measures” of this news release.

2 This release contains certain non-GAAP metrics. For reconciliations to the relevant GAAP measures and an explanation of the non-GAAP measures and reasons for their use, please refer to Exhibit 99.1.

The above revised third quarter and full year 2021 guidance excludes projected one-time M&A costs of approximately $15 million in the third quarter and $66 million for the full year. In addition, full year guidance excludes approximately $45 million of projected net sales and $11 million of projected adjusted operating profit from the E&I acquisition – assuming a Dec. 1, 2021 transaction closing date.

Johnson concluded, “Today marks the start of an important chapter for Vertiv as we announce this significant and value-creating addition to our portfolio. Vertiv is laser-focused on executing well, ensuring we are well positioned to benefit when supply chain conditions improve. Together with E&I, the future of Vertiv has never been brighter and we are excited about the potential value creation opportunities for our shareholders in both the near- and long-term.”

Conference Call

Vertiv’s management team will discuss the transaction and financial outlook today during a conference call at 9 a.m. Eastern Time. The call will contain forward-looking statements and other material information regarding the transaction and financial outlook. A webcast of the live conference call will be available for interested parties to listen to by going to the Investor Relations section of the company’s website at investors.vertiv.com. A replay of the conference call will also be available for 30 days following the webcast.

About Vertiv Holdings Co

Vertiv (NYSE: VRT) brings together hardware, software, analytics and ongoing services to ensure its customers’ vital applications run continuously, perform optimally and grow with their business needs. Vertiv solves the most important challenges facing today’s data centers, communication networks and commercial and industrial facilities with a portfolio of power, cooling and IT infrastructure solutions and services that extends from the cloud to the edge of the network. Headquartered in Columbus, Ohio, USA, Vertiv employs approximately 20,000 people and does business in more than 130 countries. For more information, and for the latest news and content from Vertiv, visit Vertiv.com.

About the E&I Engineering Group

The E&I Engineering group is a global provider of electrical switchgear and power distribution solutions with a proven track record for quality, technical expertise and customer service. With manufacturing facilities in Ireland, USA and United Arab Emirates, E&I can design, deliver and install on a global scale. E&I is globally recognized as a leader within the power distribution industry. An extensive product range, specialist technical services and a resolute focus on customer service delivers an unparalleled service that provides peace of mind for all customers. All of its products are manufactured in-house ensuring that all are of the required specification and are commercially viable and fit for purpose.

Non-GAAP Financial Measures

Financial information included in the news release to which this Exhibit is attached have been prepared in accordance with Generally Accepted Accounting Principles (“GAAP”). Vertiv has included certain non-GAAP financial measures in the news release, as further described above, that may not be directly comparable to other similarly titled measures used by other companies and therefore may not be comparable among companies. These non-GAAP financial measures may include organic net sales growth, adjusted operating profit, adjusted operating profit margin, adjusted EPS, and free cash flow, which management believes provides investors with useful supplemental information to evaluate the company’s ongoing operations and to compare with past and future periods. Management also uses certain non-GAAP measures internally for forecasting, budgeting and measuring its operating performance. These measures should be viewed as supplementing, and not as an alternative or substitute for, the company's financial results prepared in accordance with GAAP. Pursuant to the requirements of Regulation G, Vertiv has provided reconciliations of non-GAAP financial measures to the most directly comparable GAAP financial measures.

Information reconciling certain forward-looking GAAP measures to non-GAAP measures related to third quarter and full year 2021 guidance, including organic net sales growth, adjusted operating margin, and free cash flow, is not available without unreasonable effort due to high variability, complexity and uncertainty with respect to forecasting and quantifying certain amounts that are necessary for such reconciliations. For the same reasons, we are unable to compute the probable significance of the unavailable information, which could have a potentially unpredictable, and potentially significant, impact on our future GAAP financial results.

See “Reconciliation of GAAP and Non-GAAP Financial Measures” on this Exhibit 99.1 for Vertiv’s reconciliations of non-GAAP financial measures to the most directly comparable GAAP financial measures.

Cautionary Note Concerning Forward-Looking Statements

This news release, and other statements that Vertiv may make in connection therewith, may contain forward-looking statements within the meaning of the Private Securities Litigation Reform Act. This includes, without limitation, statements regarding the financial position, capital structure, indebtedness, business strategy and plans and objectives of Vertiv management for future operations, as well as statements regarding growth, anticipated demand for our products and services and our business prospects during 2021, as well as expected cost savings associated with our restructuring program. These statements constitute projections, forecasts and forward-looking statements, and are not guarantees of performance. Vertiv cautions that forward-looking statements are subject to numerous assumptions, risks and uncertainties, which change over time. Words such as “anticipate,” “believe,” “continue,” “could,” “estimate,” “expect,” “intend,” “may,” “might,” “plan,” “possible,” “potential,” “predict,” “project,” “should,” “strive,” “would” and similar expressions may identify forward-looking statements. Vertiv undertakes no obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, except as may be required under applicable securities laws.

The forward-looking statements contained or incorporated by reference in this presentation are based on current expectations and beliefs concerning future developments and their potential effects on Vertiv. There can be no assurance that future developments affecting Vertiv will be those that Vertiv has anticipated. Should one or more of these risks or uncertainties materialize, or should any of the assumptions prove incorrect, actual results may vary in material respects from those projected in these forward-looking statements. Vertiv has previously disclosed risk factors in its Securities and Exchange Commission (“SEC”) reports. These risk factors and those identified elsewhere in this presentation, among others, could cause actual results to differ materially from historical performance and include, but are not limited to: the timing and consummation of the proposed acquisition of E&I (the “Transaction”); the risk that a condition to closing the Transaction may not be satisfied; the expected expenses related to the Transaction; the possible diversion of management time on issues related to the Transaction;competition; the ability of the company to grow and manage growth profitably; maintain relationships with customers and suppliers; retain its management and key employees; factors relating to the business, operations and financial performance of Vertiv and its subsidiaries, including: global economic weakness, uncertainty and volatility; risks relating to the continued growth of Vertiv’s customers’ markets; failure to meet or anticipate technology changes; the unpredictability of Vertiv’s future operational results, including the ability to grow and manage growth profitably; disruption of Vertiv’s customers’ orders or Vertiv’s customers’ markets; less favorable contractual terms with large customers; risks associated with governmental contracts; failure to mitigate risks associated with long-term fixed price contracts; risks associated with information technology disruption or security; risks associated with the implementation and enhancement of information systems; failure to properly manage Vertiv’s supply chain or difficulties with third-party manufacturers; competition in the infrastructure technologies industry; failure to realize the expected benefit from any rationalization and improvement efforts; disruption of, or changes in, Vertiv’s independent sales representatives, distributors and original equipment manufacturers; failure to obtain performance and other guarantees from financial institutions; failure to realize sales expected from Vertiv’s backlog of orders and contracts; changes to tax law and the costs and liabilities associated with such changes and any tax audits that may arise; risks associated with future legislation and regulation of Vertiv’s customers’ markets both in the United States and abroad; costs or liabilities associated with product liability; Vertiv’s ability to attract, train and retain key members of its leadership team and other qualified personnel; the adequacy of Vertiv’s insurance coverage; a failure to benefit from future acquisitions; failure to realize the value of goodwill and intangible assets; the global scope of Vertiv’s operations; risks associated with Vertiv’s sales and operations in emerging markets; exposure to fluctuations in foreign currency exchange rates; Vertiv’s ability to comply with various laws and regulations, including but not limited to, laws and regulations relating to environmental, data protection, data privacy, anti-corruption and international trade and the costs associated with legal compliance; adverse outcomes to any legal claims and proceedings filed by or against us; Vertiv’s ability to protect or enforce its proprietary rights on which its business depends; third-party intellectual property infringement claims; liabilities associated with environmental, health and safety matters, including risks associated with the COVID-19 pandemic; risks associated with litigation or claims against Vertiv; Vertiv’s limited history of operating as an independent company; potential net losses in future periods; failure to remediate internal controls over financial reporting; our ability to realize cost savings in connection with our restructuring program; Vertiv’s level of indebtedness and the ability to incur additional indebtedness; Vertiv’s ability to comply with the covenants and restrictions contained in our credit agreements including restrictive covenants that restrict operational flexibility; Vertiv's ability to comply with the covenants and restrictions contained in our credit agreements is not fully within our control; Vertiv’s ability to access funding through capital markets; the significant ownership and influence certain stockholders have; risks associated with Vertiv’s obligations to pay portions of the tax benefits relating to pre-Business Combination tax assets and attributes; resales of Vertiv's securities may cause volatility in the market price of our securities; Vertiv's Organizational Documents contain provisions that may discourage unsolicited takeover proposals; Vertiv's Certificate of Incorporation includes a forum selection clause, which could discourage or limit stockholders’ ability to make a claim against it; the ability of Vertiv's subsidiaries to pay dividends; volatility in Vertiv's stock price due to various market and operational factors; Vertiv's ability to maintain its listing on the NYSE and comply with listing requirements; risks associated with the failure of industry analysts to provide coverage of Vertiv's business or securities and other risks and uncertainties indicated in Vertiv’s SEC reports or documents filed or to be filed with the SEC by Vertiv.

Category: Financial News

Reconciliation of GAAP and non-GAAP Financial Measures

To supplement this news release, we have included certain non-GAAP financial measures that reflect the historical financial results presented in the format of the performance metrics we are beginning to report in 2021. Management believes these non-GAAP financial measures provide investors with additional meaningful financial information that should be considered when assessing our underlying business performance and trends. Further, management believes these non-GAAP financial measures also enhance investors' ability to compare period-to-period financial results. Non-GAAP financial measures should be viewed in addition to, and not as an alternative for, the company's reported results prepared in accordance with GAAP. Our non-GAAP financial measures do not represent a comprehensive basis of accounting. Therefore, our non-GAAP financial measures may not be comparable to similarly titled measures reported by other companies. Reconciliations of each of these non-GAAP financial measures to GAAP information are also included. Management uses these non-GAAP financial measures in making financial, operating, compensation and planning decisions and in evaluating the company's performance. Disclosing these non-GAAP financial measures allows investors and management to view our operating results excluding the impact of items that are not reflective of the underlying operating performance.

Vertiv’s non-GAAP financial measures include:

- Adjusted operating profit (loss), which represents operating profit (loss), adjusted to exclude amortization of intangibles, M&A expenses and acquired sales, net;

- Adjusted operating profit (loss) margins, which represents adjusted operating profit (loss) divided by net sales; and

- Adjusted diluted EPS, which represents diluted earnings per share adjusted to exclude amortization of intangibles, change in warrant liability, and M&A expenses and acquired sales, net.

Vertiv Holdings Co

Reconciliation of GAAP Operating Profit to Non-GAAP Adjusted Financial Performance

Third Quarter 2020

| Operating Profit |

Interest expense, net |

Change in Warrant Liability |

Income tax expense |

Net income (loss) |

Diluted EPS (1) | |

|---|---|---|---|---|---|---|

| GAAP | $ 35.1 | $ 26.4 | $ 87.7 | $ 24.5 | $ (103.5) | $ (0.32) |

| Amortization of intangibles | 32.5 | — | — | — | 32.5 | 0.10 |

| Change in warrant liability | — | — | (87.7) | — | 87.7 | 0.27 |

| Pro forma share count1 | — | — | — | — | — | — |

| Non-GAAP Adjusted | $ 67.6 | $ 26.4 | $ — | $ 24.5 | $ 16.7 | $ 0.05 |

Fourth Quarter 2020

| Operating Profit |

Interest expense, net |

Change in Warrant Liability |

Income tax expense |

Net income (loss) |

Diluted EPS (2) | |

|---|---|---|---|---|---|---|

| GAAP | $ 120.1 | $ 25.0 | $ 34.4 | $ 20.2 | $ 40.5 | $ 0.12 |

| Amortization of intangibles | 31.6 | — | — | — | 31.6 | 0.10 |

| Change in warrant liability | — | — | (34.4) | — | 34.4 | 0.10 |

| Pro forma share count2 | — | — | — | — | — | (0.03) |

| Non-GAAP Adjusted | $ 151.7 | $ 25.0 | $ — | $ 20.2 | $ 106.5 | $ 0.29 |

Full Year 2020

| Operating Profit |

Interest expense, net |

Loss on extinguishment of debt | Change in Warrant Liability |

Income tax expense |

Net income (loss) |

Diluted EPS (3) | |

|---|---|---|---|---|---|---|---|

| GAAP | $ 213.5 | $ 150.4 | $ 174.0 | $ 143.7 | $ 72.7 | $ (327.3) | $ (1.07) |

| Amortization of intangibles | 128.7 | — | — | — | — | 128.7 | 0.42 |

| Change in warrant liability | — | — | — | (143.7) | — | 143.7 | 0.47 |

| Pro forma share count3 | — | — | — | — | — | — | 0.03 |

| Non-GAAP Adjusted | $ 342.2 | $ 150.4 | $ 174.0 | $ — | $ 72.7 | $ (54.9) | $ (0.15) |

(1) GAAP Diluted EPS based on 328.4 million shares. Non-GAAP Adjusted EPS based on pro forma share count of 362.0 million diluted shares (includes basic shares and potential dilutive warrants, stock options and restricted stock units). We believe that this presentation facilitates comparison to the current period due to the impact of the reverse merger.

(2) GAAP Diluted EPS based on 333.3 million shares. Non-GAAP Adjusted EPS based on pro forma share count of 362.0 million diluted shares (includes basic shares and potential dilutive warrants, stock options and restricted stock units). We believe that this presentation facilitates comparison to the current period due to the impact of the reverse merger.

(3) GAAP Diluted EPS based on 307.1 million shares. Non-GAAP Adjusted EPS based on pro forma share count of 362.0 million diluted shares (includes basic shares and potential dilutive warrants, stock options and restricted stock units). We believe that this presentation facilitates comparison to the current period due to the impact of the reverse merger.

Vertiv Holdings Co

2021 Adjusted Guidance

Reconciliation of GAAP Operating Profit to Non-GAAP Adjusted Financial Performance1, 2

Third Quarter 2021

| Operating Profit |

Interest expense, net |

Change in Warrant Liability |

Income tax expense |

Net income (loss) |

Diluted EPS (3) | |

|---|---|---|---|---|---|---|

| GAAP | $ 83.0 | $ 20.0 | — | $ 43.0 | $ 20.0 | $ 0.05 |

| Amortization of intangibles | 32.0 | — | — | — | 32.0 | 0.09 |

| Change in warrant liability | — | — | — | — | — | — |

| M&A expenses and acquired sales, net | 15.0 | — | — | — | 15.0 | 0.04 |

| Non-GAAP Adjusted | $ 130.0 | $ 20.0 | — | $ 43.0 | $ 67.0 | $ 0.18 |

Fourth Quarter 2021

| Operating Profit |

Interest expense, net |

Change in Warrant Liability |

Income tax expense |

Net income (loss) |

Diluted EPS (4) | |

|---|---|---|---|---|---|---|

| GAAP | $ 92.8 | $ 21.9 | — | $ 39.7 | $ 31.2 | $ 0.08 |

| Amortization of intangibles | 31.3 | — | — | — | 31.3 | 0.08 |

| Change in warrant liability | — | — | — | — | — | — |

| M&A expenses and acquired sales, net | 40.0 | — | — | — | 40.0 | 0.11 |

| Non-GAAP Adjusted | $ 164.1 | $ 21.9 | — | $ 39.7 | $ 102.5 | $ 0.28 |

Full Year 2021

| Operating Profit |

Interest expense, net |

Loss on extinguishment of debt | Change in Warrant Liability |

Income tax expense |

Net income (loss) |

Diluted EPS (5) | |

|---|---|---|---|---|---|---|---|

| GAAP | $ 358.0 | $ 86.0 | $ 0.4 | $ 84.8 | $ 94.0 | $ 92.8 | $ 0.25 |

| Amortization of intangibles | 127.0 | — | — | — | — | 127.0 | 0.35 |

| Change in warrant liability | — | — | — | (84.8) | — | 84.8 | 0.23 |

| M&A expenses and acquired sales, net | 55.0 | — | — | — | — | 55.0 | 0.15 |

| Non-GAAP Adjusted | $ 540.0 | $ 86.0 | $ 0.4 | $ — | $ 94.0 | $ 359.6 | $ 0.99 |

(1) Information reconciling certain forward-looking GAAP measures to non-GAAP measures related to Q3 2021 guidance, including organic net sales growth and free cash flow, is not available without unreasonable effort due to high variability, complexity and uncertainty with respect to forecasting and quantifying certain amounts that are necessary for such reconciliations. For the same reasons, we are unable to compute the probable significance of the unavailable information, which could have a potentially unpredictable, and potentially significant, impact on our future GAAP financial results.

(2) Management believes adjusting operating profit to exclude M&A expenses provides investors with additional meaningful financial information that should be considered when assessing our underlying business performance and trends, and more easily compares such results with our peers in evaluating the company's performance. Disclosing this non-GAAP financial measure allows investors and management to view our operating results excluding the impact of items that are not reflective of the underlying operating performance.

(3) GAAP Diluted EPS and non-GAAP adjusted EPS based on 363.8 million shares (includes ~352.2 million basic shares and ~11.6 million potential dilutive warrants, stock options and restricted stock units).

(4) GAAP Diluted EPS and non-GAAP adjusted EPS based on 372.3 million shares (includes ~352.2 million basic shares before transaction, 7.7 million weighted average shares issued for the transaction and ~12.3 million potential dilutive warrants, stock options and restricted stock units). Assumes 23 million shares issued in conjunction with the transaction.

(5) GAAP Diluted EPS and non-GAAP adjusted EPS based on 364.2 million shares (includes ~351.6 million basic shares before transaction, ~1.9 million weighted average shares issued for the transaction and ~10.7 million potential dilutive warrants, stock options and restricted stock units). Assumes 23 million shares issued in conjunction with the transaction.

View source version on businesswire.com: https://www.businesswire.com/news/home/20210908005563/en/

For investor inquiries, please contact:

Lynne Maxeiner

Vice President, Global Treasury & Investor Relations

Vertiv

T +1 614-841-6776

E: lynne.maxeiner@vertiv.com

For media inquiries, please contact:

Scott Deitz

FleishmanHillard for Vertiv

T +1 336-908-7759

E: scott.deitz@fleishman.com

Source: Vertiv Holdings Co